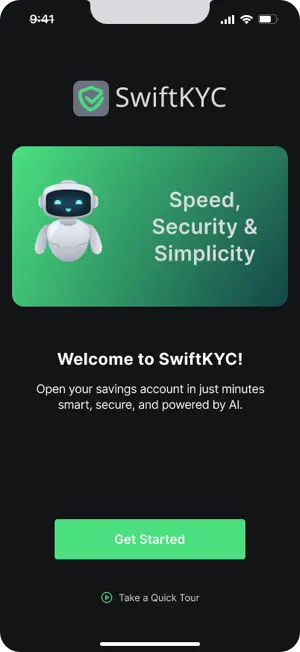

SwiftKYC – AI-powered registration

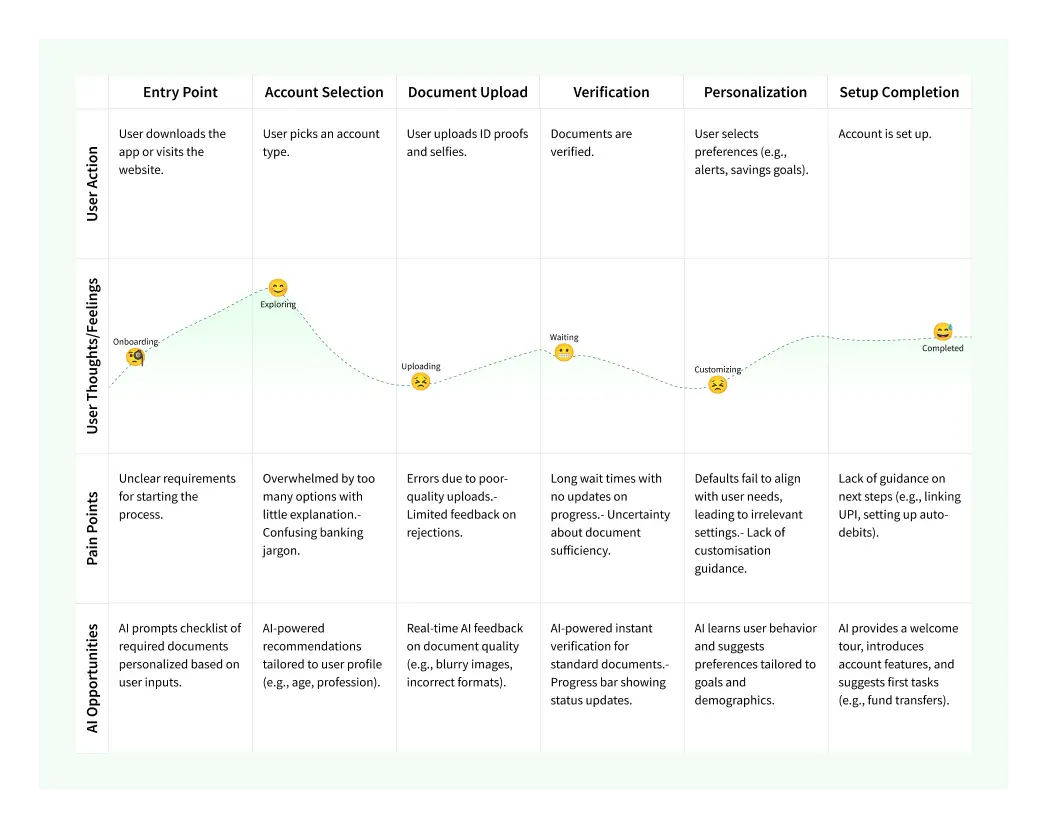

A concept case study exploring how explainable AI can make digital KYC registration faster, clearer, and more trustworthy.

Role:

Lead Product Designer

Timeline:

4 weeks

Tools:

Figma, FigJam

Platforms:

Web + responsive mobile

My focus:

Research, Journey mapping, Wireframes, Visual Design

Overview

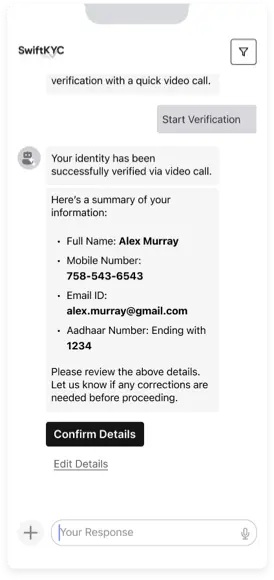

SwiftKYC reimagines the registration process for banks by using conversational design and AI validation. The goal: reduce drop-offs, catch errors early, and make compliance less intimidating for users while giving agents tools that save time.

The Problem

- Users abandon registration when documents are rejected without explanation.

- Agents spend hours validating fields manually.

- Lack of clarity erodes trust and increases support load.

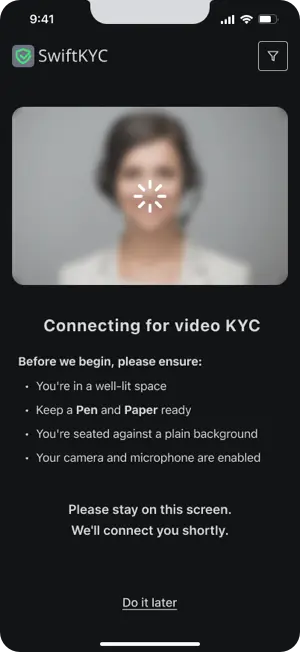

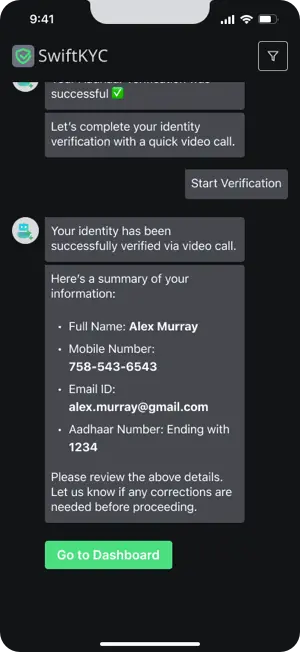

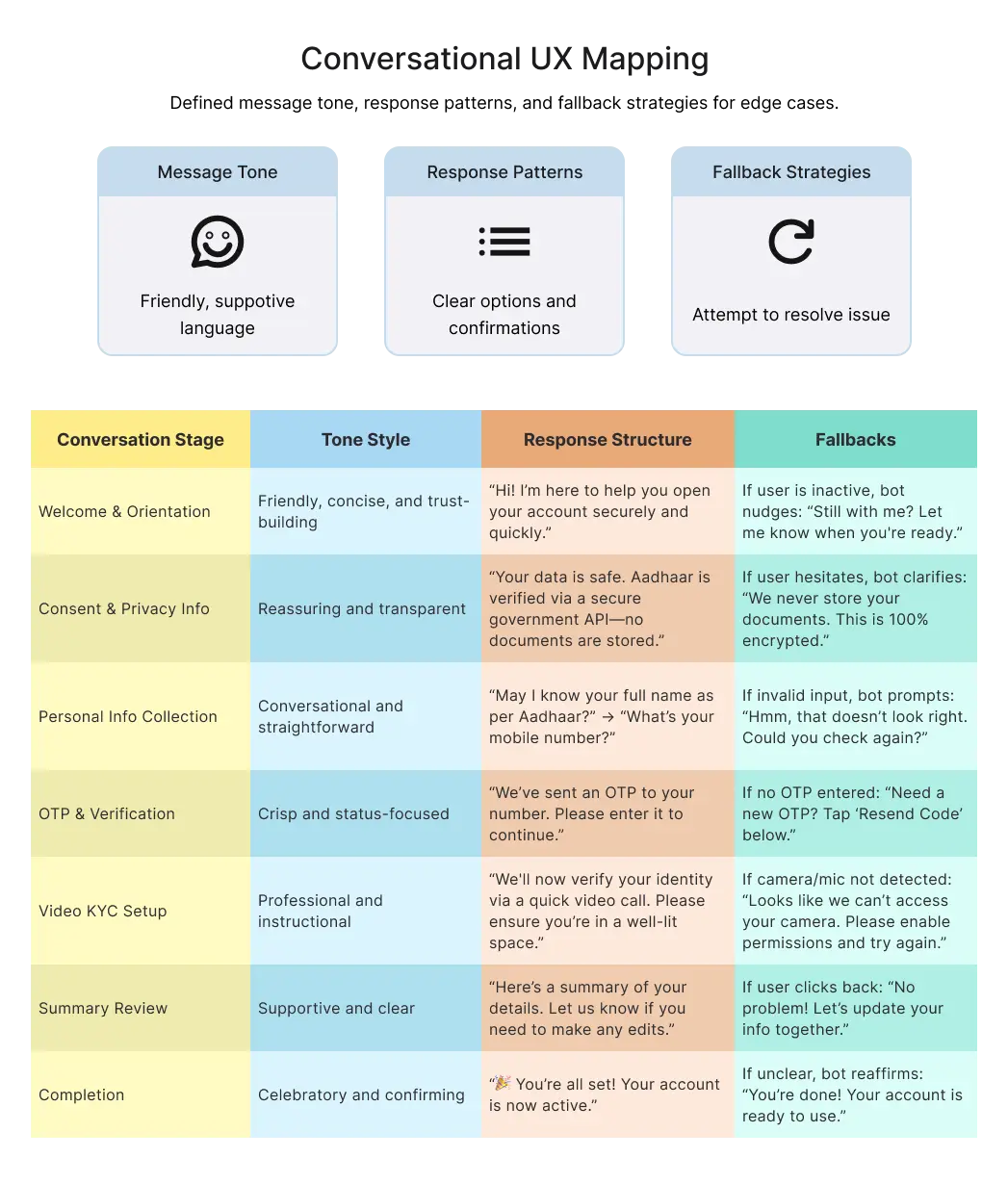

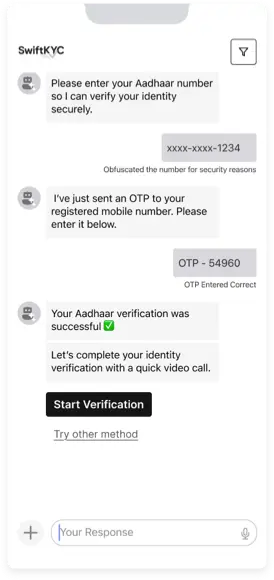

Interaction Focus

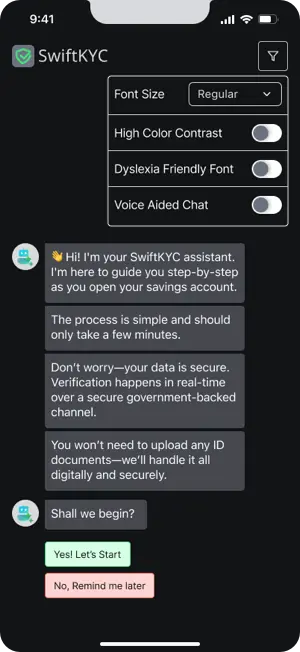

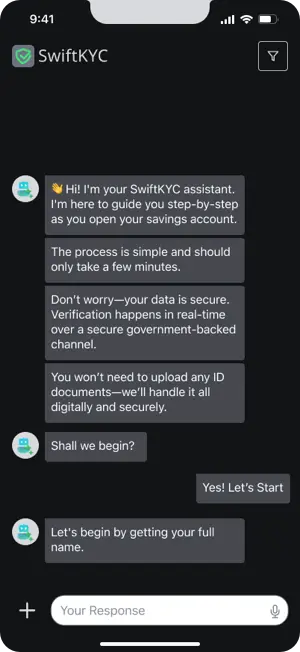

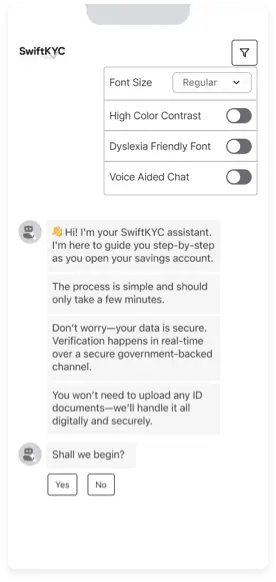

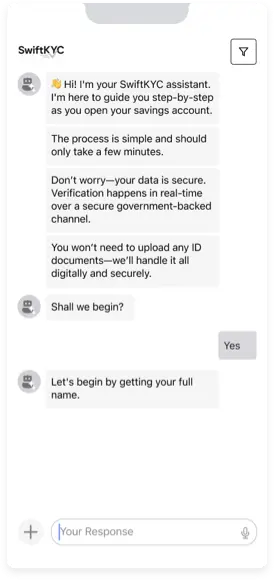

Guide with Conversation

Broke long forms into step-by-step conversational prompts, so users tackled one action at a time instead of facing overwhelming inputs.

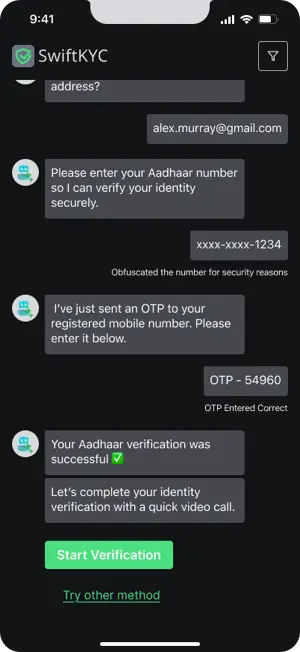

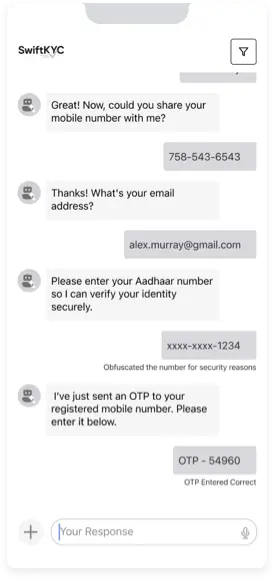

Validate Inline with AI

Embedded AI checks directly into the flow, catching errors as soon as they were entered — cutting re-submissions by 40%.

Surface Errors Early

Low-confidence fields triggered contextual tips (e.g., “Retake photo for better lighting”), reducing frustration and failed attempts.

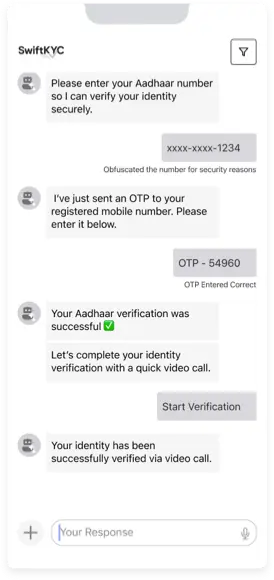

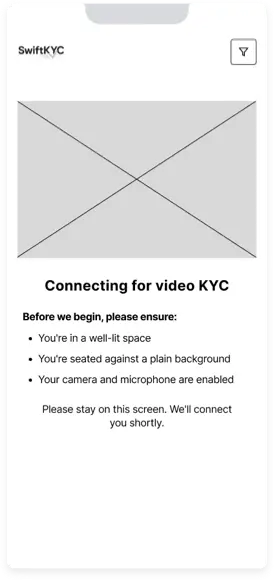

Disclose Progressively

Kept advanced steps (like liveness checks or document authenticity) running in the background, surfacing them only when necessary to avoid cognitive overload.

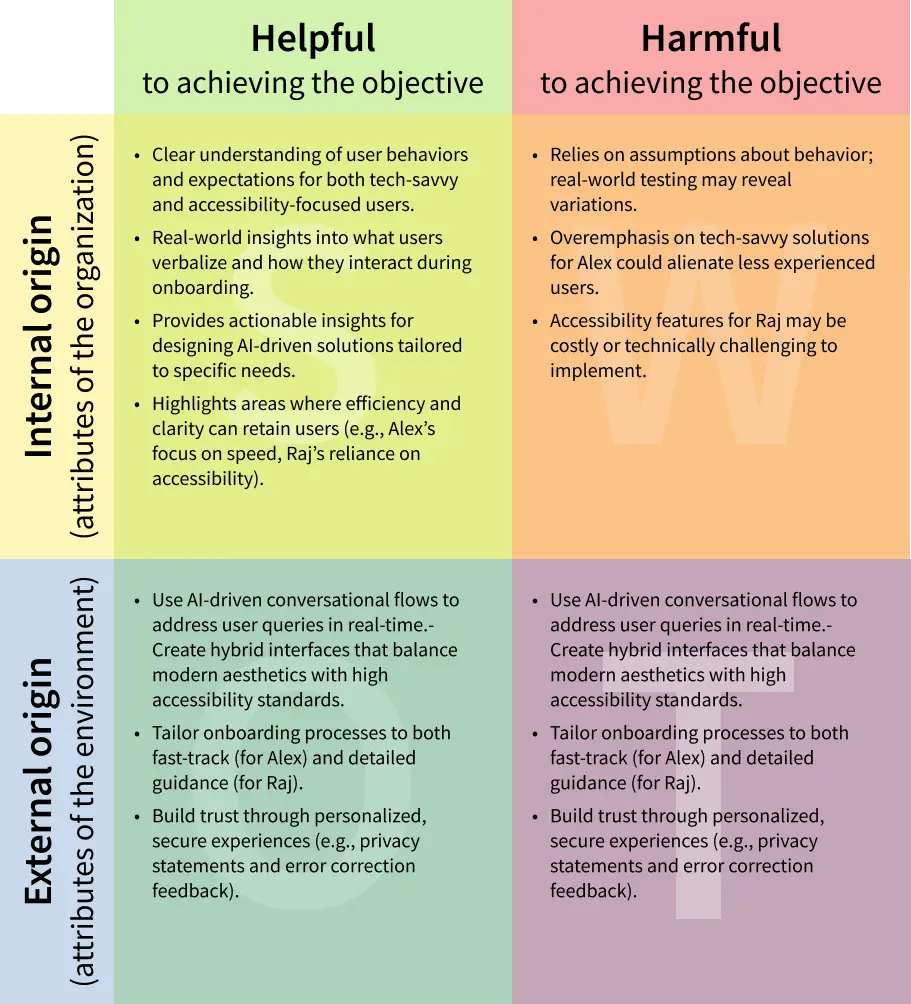

SWORT

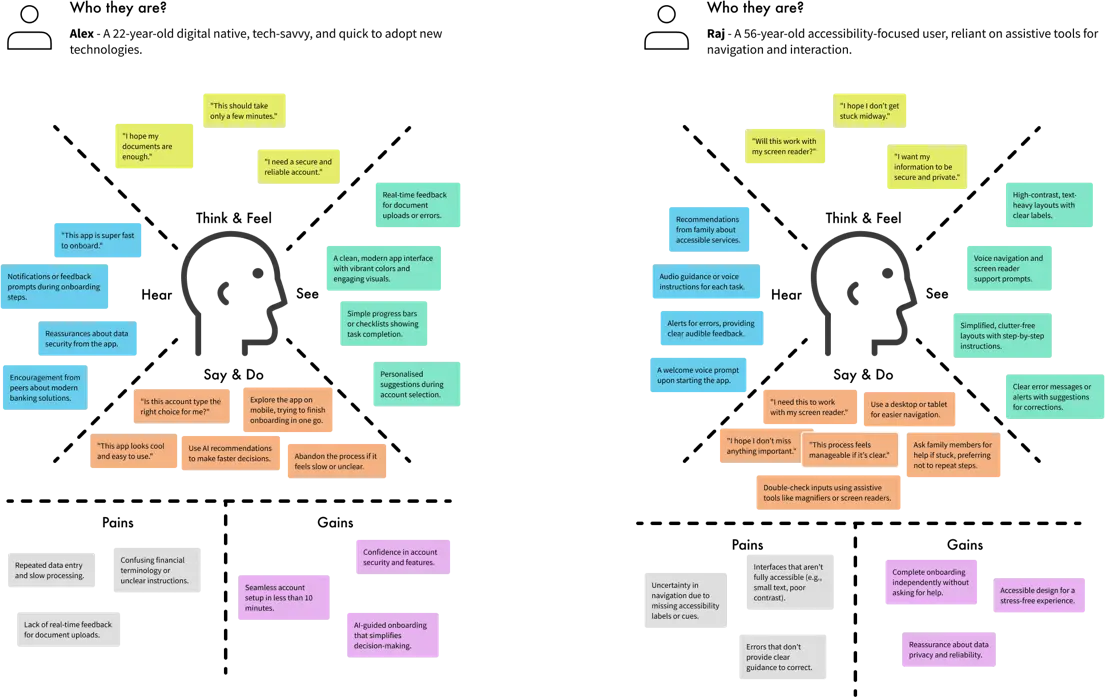

Empathy Map

Key Design Decisions

- Explainable AI – surfaced why a document was flagged, increasing confidence.

- Inline Validation – reduced re-submissions by showing errors in real time.

- Conversational Prompts – guided users step by step instead of long forms.

- Accessibility by Default – WCAG-compliant, multilingual flows.

Wireframe

Visual Design